The International Energy Agency (IEA) is the energy watchdog of the industrial world. The developed nations of the world were caught off guard by the oil crisis of 1973. They then realized energy resources are so fundamental to all of civilization, and recognized how vulnerable we are to supply disruptions. Forty years ago in 1974, the International Energy Agency was formed, tasked with keeping an eye on these precious resources, and providing policy makers around the world with information to make better informed planning decisions.

The primary deliverable from the IEA is the massive World Energy Outlook (WEO) report that is released annually in November. Concerned about peak oil, I began reading the Executive Summary to this report 10 years ago. Five years ago I wrote a summary of what the report has been telling us from 2005 – 2009, concerning issues related to peak oil: The IEA and World Oil Supply Projections. Given that another 5 years have passed, I offer an update, which will bring us to today’s release of the 2014 World Energy Outlook.

The short version is this: The IEA World Energy Outlook has gradually moved from rosy to pessimistic reports over the last ten years, or what Stuart Staniford called “increasingly reality-based.” Over the last decade, the report’s projected oil demand has gradually decreased by 20 million barrels per day (mb/d), and the projected costs have continued to rise. Yet even their most pessimistic reports, I believe, fail to capture true reality. It seems that politics plays a strong role in what is allowed to be published. It also must be stated that predicting the future “is a fool’s errand,” as Kurt Cobb reminds us in his review of the 2013 report.

Not that the report tries to predict the future – its purported purpose is to lay out realistic scenarios that allow for intelligent planning by policymakers. However, the scenarios have not turned out to be realistic, and that’s the rub.

So why should we pay any attention at all to these yearly exercises? 1) because the IEA has access to the most comprehensive data available; 2) because there is much useful information if you learn to read between the lines; and 3) because they are considered the voice of authority by so many; and 4) because it is intriguing (to me anyway), to follow the trajectory, year by year, comparing the changes and the contradictions, and trying to learn something in the process.

The bottom line of the latest report released today, November 12, 2014, is that we live with an energy system under extreme stress and danger, and sustained political efforts are essential and urgent if we are to avert both supply disruptions and climate disaster. For a couple of independent reports that I feel are more realistic, see the end of the post.

Prior to 2005: Watchdog Fail

It has been reported that the IEA was aware of peak oil as far back as 1998. Researcher Lionel Badal has uncovered the story (a fascinating tale) that the 1998 WEO contained an oil supply graph that included “a balancing item” that they named “unidentified unconventional oil” that conveniently made up for shortages beyond 2010. This was said to have been a code to indicate peak oil.

The political fallout that resulted after publication of that report resulted in very conservative WEO reports from 2000 to the present.

Part 1: A Recap of 2005 – 2009

2005: Don’t Worry, Be Happy

2005 was the year world oil production begain its multi-year plateau, after steady increases for many years, and is now regarded by many as the world peak of conventional oil production (see also here). It was also the year The Hirsch Report was produced for the U.S. Dept. of Energy, warning that “The peaking of world oil production presents the U.S. and the world with an unprecedented risk management problem,” and that mitigation needed to be implemented 20 years in advance of the peak.” In 2005, peak oil was still seen as a pretty fringe idea. The then executive director of the IEA, Claude Mandil dismissed the idea of peak oil out of hand and stated confidently that “Hydrocarbon resources around the world are abundant and will easily fuel the world through its transition to a sustainable energy future.” [International Energy Agency, 2005. Resources to Reserves: Oil and Gas Technologies for the Energy Markets of the Future, page 3. IEA, Paris, quoted by G. Monbiot, http://www.monbiot.com/2008/12/15/at-last-a-date/]. In the 2005 WEO, Oil demand by 2030 was projected to be 120 mb/d.

2006: Expectations Lowered

In 2006, the peak oil community was pointing out that after years of steadily increasing supply of oil, production had been flat for a full year since 2005 – perhaps “peak oil” had arrived. The 2006 WEO began lowering expectations of demand growth from 120 million barrels per day (mb/d) to 116 mb/d by 2030.

2007: A Supply Crunch in 2015?

The tone of the 2007 World Energy Outlook was noticeably becoming less rosy. They discussed decline in output from existing fields, admitted the possibility of a temporary supply crunch in 2015, and expressed concern about whether investment needed to meet future demand would be forthcoming. It was noted that we were becoming more dependent on a few Middle Eastern countries as declines in output from other countries increased. Demand was still projected to be 116 mb/d by 2030.

2008: Findings Replace Assumptions, and Time Is Not On Our Side

2008 marked a significant change in the stance of the IEA in regards to peak oil. The IEA has always focused on projecting oil demand, assuming supply would be forthcoming (as a commenter correctly reminded me in response to my 2009 article). For the first time, the 2008 WEO had undertaken a detailed examination of the 800 largest oilfields and seriously considered supply concerns. And for the first time they acknowledged the peaking or plateauing of conventional oil production: “Although global production in total is not expected to peak before 2030, production of conventional oil…is projected to level off towards the end of the projection period.” Decline rates of existing fields were changed from 3.7% in the previous year to 6.7% in 2008, and projecting an 8.6% decline rate by 2030. Oil demand projected for 2030 declined from 116 mb/d to 106 mb/d – revised downward by 10 mb/d, with additional concern that “there can be no guarantee that [these “plentiful” resources] will be exploited quickly enough to meet the level of demand projected.” Considering the dramatic change from previous years projections, British journalist George Monbiot asked IEA chief economist Fatih Birol what the previous figures were based on. The reply: “It was mainly an assumption, a global assumption about the world’s oil fields….Last year it was an assumption, and this year it’s a finding of our study.” Birol further clarified his expectation that conventional oil would come to a “plateau” around 2020, and saying “I think time is not on our side here.”

The WEO 2008 Executive Summary emphasized not only supply concerns, but also the ongoing problem of policy makers avoidance of addressing climate change: “Current global trends in energy supply and consumption are patently unsustainable – environmentally, economically, socially… It is not an exaggeration to claim that the future of human prosperity depends on how successfully we tackle the two central energy challenges facing us today: securing the supply of reliable and affordable energy; and effecting a rapid transformation to a low-carbon, efficient and environmentally benign system of energy supply. What is needed is nothing short of an energy revolution… The sources of oil to meet rising demand, the cost of producing it and the prices that consumers will need to pay for it are extremely uncertain, perhaps more than ever.” The Summary ends with a strong warning: “Time is running out and the time to act is now.”

2009: The Whistleblowers

Days prior to the release of the 2009 report, a front page article in The Guardian told us that “Key oil figures were distorted by US pressure, says whistleblower.”

“The world is much closer to running out of oil than official estimates admit, according to a whistleblower at the International Energy Agency who claims it has been deliberately underplaying a looming shortage for fear of triggering panic buying.

The senior official claims the US has played an influential role in encouraging the watchdog to underplay the rate of decline from existing oil fields while overplaying the chances of finding new reserves.

The allegations raise serious questions about the accuracy of the organisation’s latest World Energy Outlook on oil demand and supply to be published tomorrow – which is used by the British and many other governments to help guide their wider energy and climate change policies…”

This article reinforced my already existing opinion that 1) The WEO is written by committee, and represents numerous interests, resulting in reports that tend to favor conservative statements, and 2) that political influence also strongly tempers what is allowed to be conveyed in these reports. Reading the Executive Summaries, one often gets there are competing, sometimes contradictory ideas vying for predominance. These reports, therefore, have to be read with a grain of salt, and a carefull eye to read between the lines. What keeps me coming back to these reports each year is this tracking of the changes to their statements over time – mostly in the direction of increased pessimism.

What is interesting is that these revelations came at a time when the report was actually at its strongest in terms of warnings about oil supply. In fact, deputy executive director Richard Jones stated, in a reply to the allegations, “We’re the ones that are out there warning that the oil and gas is running out in the most authoritative manner. But we don’t see it happening as quickly as some of the peak oil theorists. Generally, we’re viewed as more pessimistic than we should be by the (oil) industry.”

The 2009 WEO reports the results of two scenarios: a Reference Scenario – a baseline of expectations if governments make no changes to existing policies; and a 450 Scenario, “which depicts a world in which collective policy action is taken to limit the long-term concentration of greenhouse gases in the atmosphere to 450 parts per million of CO2-equivalent (ppm CO2-eq).” Continuing on the current energy path in the Reference Scenario is said to lead to “alarming consequences for climate change and energy security.” Oil demand in 2030 is expected to be 105 mb/d, down just 1 mb/d from the 2008 report, but they state that for importing countries this would require “increasingly high level of spending…representing a major economic burden for importers, with OECD countries spending 2% of their GDP on oil and gas imports.

Part 2: 2010-2014: “Will Peak Oil be a Guest, or the Spectre at the Feast?”

2010: Peak Oil Occurred in 2006 – Did We Forget to Tell You?

The 2010 WEO is notable for a casually dropped bombshell, which the mainstream media ignored: peak oil, which was derided in 2005, ignored in 2006-2007, acknowledged in 2008 with the statement “production of conventional oil…is projected to level off towards the end of the projection period [of 2030];” leaked by IEA whistleblowers in 2009, and now in the 2010 report we’re explicitly told that conventional oil peaked 4 years prior in 2006! See how it is nonchalantly dropped in the following sentence: “Crude oil output reaches an undulating plateau of around 68-69 mb/d by 2020, but never regains its all-time peak of 70 mb/d reached in 2006, while production of natural gas liquids (NGLs) and unconventional oil grows strongly.”

So, of course, this is not really a problem, according to the WEO, because natural gas liquids and unconventional oil [tar sands, shale oil (tight oil), oil shales, biofuels, etc.] will make up the difference (at least until 2035), provided, of course, that the usual caveat of proper investment is attended to.

Peak oil analyst Stuart Staniford noted about the 2010 report, “Suddenly, the subject of impending peak has gone from not worthy of discussion to in the past already!”

New Policies Not Adequate for the Crisis We Face

In 2010, three scenarios are presented: The Current Policies Scenario, which projects a 1.4% energy demand growth, a 450 Scenario (a scenario designed to keep climate change to 2 degrees C of warming), which projects a 0.7% demand growth, and, for the first time, a New Policies Scenario, “that anticipates future action by governments to meet the commitments they have made to tackle climate change and growing energy insecurity.” The New Policies Scenario projects an energy demand growth of 1.2% per year. For comparison, it is noted that the previous 27 year period experienced 2% demand growth per year. It is acknowledged that the New Policies are not nearly adequate for the crisis we face. These new policies suggest trends that could put greenhouse gases at over 650 ppm, and would likely result in a temperature increase of more than 3.5 degrees C.

40% of Oil to Come from Fields Not Yet Found

Nevertheless, New Policies now becomes the reference scenario in the WEO, and oil demand is projected to reach 99 mb/d in 2035 under this scenario (down from 105 mb/d by 2030 in 2009). To get to those 99 mb/d, the report sees OPEC needing to boost its output by over one-half, with Iraq tasked with “a large share” of that increase. Non-OPEC oil production is expected to be held broadly constant by unconventional oil production and natural gas liquids (NGL), which will then start to drop at the end of the period. The report then offers another disclaimer: “The size of ultimately recoverable resources of both conventional and of unconventional oil is a major source of uncertainty for the long-term outlook for world oil production.” For me, it does not inspire much confidence to be putting our hopes for a growing supply of oil for the next 20 years on the Middle East, especially when the bulk of it must come from Iraq. According to the report, 40% of oil production in 2035 will need to come from fields not yet found.

Permission is granted to jump to the end of this post to see the 2014 graph showing a decline in unconventional oil produced by Brazil, Canada, and the U.S. well before the 2030s.

A Cry for Help

It is also important to note that the WEO sees increasing demand to come primarily from the non-OECD countries (i.e. China and India), as the rest of the industrialized world decreases consumption. Kjell Aleklett, ASPO President, characterized the WEO 2010 as “a cry for help,” stating that the IEA avoids discussion of economic growth in the west, interpreting it to mean that economic growth will not be possible:

“The IEA now sees OECD oil consumption falling from today’s 41.7 mb/d to

35.3 mb/d by 2035. This means that all OECD nations, including Australia, must revise down their future consumption estimates. Non-OECD nations are now expected to increase their oil consumption by 19 mb/d by 2035. Two thirds of this will come from China and India.”

Aleklett concludes:

“By showing this data without announcing this obvious conclusion [that the peak of total oil production is imminent] the IEA is making a cry for help to do what, for them, is politically impossible. WEO 2010 is a cry for help to tell the truth about peak oil.”

2011: “If We Don’t Change Direction Soon, We’ll End Up Where We’re Heading”

The 2011 WEO report actually does offer the useful advice that “If we don’t change direction soon, we’ll end up where we’re heading.” This reminds me of the adage I heard from Matt Simmons: “When you find yourself stuck in a hole, rule number 1 is to stop digging.”

The Year of Living Dangerously

2011 was the year of the Fukushima Daiichi nuclear disaster, the Arab Spring, and the beginning of Occupy Wall Street. The WEO report noted there were few signs that the “urgently needed” change in direction of global energy trends were underway, “boding ill for agreed global climate change objectives,” and they offer this grim prognostication: “China is projected to consume nearly 70% more energy than the U.S. in 2035, yet per-capita energy consumption will still be less than half the level in the U.S.”

They acknowledge some steps in the right direction – “Half of the new power capacity installed [to the year 2035] will come from renewable energy technologies” – but that “the door [limiting climate change] to 2 degrees C is closing.” Another grim statement: “Four-fifths of the total energy-related CO2 emissions permissible by 2035 in the 450 Scenario is already ‘locked-in’ by our existing capital stock.”

Mindful of MENA

Projected demand for oil remains at 99 mb/d for 2035. “To compensate for declining crude oil production at existing fields, 47 mb/d capacity additions are required, twice the current total oil production of all OPEC countries in the Middle East.” Once again, the shortfall is expected to be made up from NGL, unconventional sources, and the largest increase from Iraq. Light tight oil (LTO, or shale oil) from the U.S. is acknowledged as playing a significant role to allow us to decrease imports, but the IEA is not yet hailing it as the savior (but see below regarding natural gas). Also mentioned is an increasing dependence on oil from the MENA (Middle East/North Africa) region, which must rely on vulnerable supply routes. “In aggregate, the increase in production from this region is over 90% of the required growth in world oil output, pushing the share of OPEC in global production above 50% in 2035.” With the caveat, again, of sufficient investment.

Natural Gas – You Gotta Wear Shades!

Dropping the caveats of uncertainty, the report trumpets “Golden prospects for natural gas… a bright future, even a golden age, for natural gas.” This is due to the revolution in hydraulic fracturing (“fracking”) and horizontal drilling, making unconventional gas half of the estimated resource base.

The Nuclear Conundrum – Can’t Live With It, Can’t Live Without It

In the wake of Fukushima, the report warns, “The consequences [of a low-nuclear future] would be particularly severe for those countries with limited indigenous energy resources which have been planning to rely relatively heavily on nuclear power. It would also make it considerably more challenging for emerging economies to satisfy their growing demand for electricity.”

2012: Don’t Look Over Here – Everything’s OK, and the Kids Will Be Alright!

The 2012 WEO report is marked by a temporary return to a tempered exuberance and brings the shale oil (light, tight oil, or LTO) explosion in the U.S. to the fore: “A new global energy landscape is emerging. The global energy map is changing, with potentially far-reaching consequences for energy markets and trade. It is being redrawn by the resurgence in oil and gas production in the United States and could be further reshaped by a retreat from nuclear power in some countries, continued rapid growth in the use of wind and solar technologies and by the global spread of unconventional gas production. Perspectives for international oil markets hinge on Iraq’s success in revitalizing its oil sector. If new policy initiatives are broadened and implemented in a concerted effort to improve global energy efficiency, this could likewise be a game-changer.” [Emphasis theirs]

Locking-In Climate Change

And yet the report acknowledges in the next sentence that alas, “the world is still failing to put the global energy system onto a more sustainable path.” Subsidies for fossil fuels in 2011 were $523 billion – 6 times more than they were for renewables and 30% higher than they were in 2010. In regards to climate change, this statement stands out: “If action to reduce CO2 emissions is not taken before 2017, all the allowable CO2 emissions would be locked-in by energy infrastructure existing at that time. Rapid deployment of energy-efficient technologies – as in our Efficient World Scenario – would postpone this complete lock-in to 2022, buying time to secure a much-needed global agreement to cut greenhouse-gas emissions.”

The U.S. All but Self-Sufficient – “Saudi America”!?

Due to the development of light, tight oil, the United States is projected to overtake Saudi Arabia, and become the largest oil producer through to the mid 2020s. It is projected that North America becomes a net oil exporter by 2030 (presumably combining LTO from the U.S. with the tar sands from Canada). “The United States, which currently imports around 20% of its total energy needs, becomes all but self-sufficient in net terms – a dramatic reversal of the trend seen in most other energy-importing countries.” [Emphasis theirs]

In regards to oil demand expected in 2035, the quantity remains from 2011 (99 mb/d), but the price has increased from $210/barrel in nominal terms to $215/barrel.

The Devil is in the Details – Counting on Iraq

Despite the resurgence from LTO in the U.S. noted above, “supply after 2020 depends increasingly on OPEC.” “Much is riding on Iraq’s success” the report tells us, with Iraq making “the largest contribution by far to global oil supply growth.”

So, while the overall tone of the report is positive and optimistic, the details sometimes send a different, contradictory message. Yet it was the “good news” about the fracking boom in the U.S. that garnered front page headlines around the world, and has stuck in the consciousness and zeitgeist since then. Countless articles since then have reminded us in various contexts that “the world is awash in oil.”

In contrast to this industry promoted meme, Michael Klare had a very different takeaway:

“Given the hullabaloo about rising energy production in the U.S., you would think that the IEA report was loaded with good news about the world’s future oil supply. No such luck. In fact, on a close reading anyone who has the slightest familiarity with world oil dynamics should shudder, as its overall emphasis is on decline and uncertainty.”

Renewables are expected to become the second-largest source of power in the world by 2035 and will closely match coal as a source of electricity. This transformation is being driven by falling technology costs, rising fossil-fuel prices, and continued subsidies.

Energy is Thirsty

Water is given some attention in this year’s report, acknowledging that “energy is becoming a thirstier resource,” with water needs projected to grow at twice the rate of energy demand. “The vulnerability of the energy sector to water constraints is widely spread geographically,” increasingly affecting many of the existing and emerging energy technologies, such as shale gas development, Canadian tar sands, maintaining power plants in India, and maintaining oil field pressures.

Really, Truly Ugly

I’ll mention again Michael Klare’s analysis of the 2012 report, which I highly recommend (The Good, the Bad, and the Really, Truly Ugly). He writes,

“Its portrait of our global energy future should have dampened enthusiasm everywhere, focusing as it did on an uncertain future energy supply, excessive reliance on fossil fuels, inadequate investment in renewables, and an increasingly hot, erratic, and dangerous climate.”

2013: Era of Oil Abundance is Cancelled

The 2013 WEO Report repeats some of the themes from 2012: “China dominates the picture within Asia, before India takes over from 2020 as the principle engine of growth. …China is about to become the largest oil-importing country and India becomes the largest importer of coal by the early 2020s. The United States moves steadily towards meeting all of its energy needs from domestic resources by 2035.” And the world is still on a trajectory towards 3.6 degrees C of global warming.

No Era of Abundance? That’s Not the Future We Ordered!

It is noted that the sustained high price of oil at $110 per barrel since 2011 is “without parallel in oil market history.” The claim for U.S. shale oil is similar to those made in 2012, but the tone is not as optimistic sounding:

“Light tight oil shakes the next ten years, but leaves the longer term unstirred. The capacity of technologies to unlock new types of resources, such as light tight oil (LTO) and ultra-deepwater fields… But this does not mean that the world is on the cusp of a new era of oil abundance. …no country replicates the level of success with LTO that is making the United States the largest global oil producer. The rise of unconventional oil (including LTO) and natural gas liquids is meets the growing gap between global oil demand, which rises by 14 mb/d to reach 101 mb/d in 2035, and production of conventional crude oil which falls back slightly to 65 mb/d.”

In the next paragraph, a statement somewhat contradictory of the previous paragraph is made: “The role of OPEC countries in quenching the world’s thirst for oil is reduced temporarily over the next ten years by rising output from the United States, from oil sands in Canada, from deepwater production in Brazil and from natural gas liquids from all over the world. But, by the mid-2020s, non-OPEC production starts to fall back and countries in the Middle East provide most of the increase in global supply.” In one sentence the U.S. is seen as meeting “the growing gap” between demand and conventional crude to 2035, and in another it is implied that the U.S., or at least non-OPEC production in total will be declining a decade earlier by the mid 2020s.

6% Declines in Conventional Oil Fields, More Rapid Declines for Unconventional

As first reported in 2008 (examining 800 fields), we are reminded that the IEA analysis (of 1600 fields this time) confirms that “once production has peaked, an average conventional field can expect to see annual declines in output of around 6% per year…. the implication is that conventional crude output from existing fields is set to fall by more than 40 mb/d by 2035.”

And finally, the rapid rate of decline in unconventional fields, and a startling admission: “most unconventional plays are heavily dependent on continuous drilling to prevent rapid field-level declines. Of the 790 billion barrels of total production required to meet our projections for demand to 2036, more than half is needed just to offset declining production.” Which prepares us for 2014…

A Dramatic Shift in Stance and Tone: A Short Lived Shale Boom

In June of this year (2014), I wrote a post titled New Energy Report from I.E.A. Forecasts A Decline in North American Energy Supply about a special report titled World Energy Investment Outlook. I noted the dramatic shift in stance and in tone from 2012, when the agency forecast that the U.S. would overtake Saudi Arabia in oil production by 2020, and that North America would be a net oil exporter by 2030. Now they were telling us that output from North America will plateau and then fall back from the mid-2020s onwards.

The other important aspect of this special report was its careful look at the amount of investment that will be required going forward. I wrote:

The focus of the new report released by the IEA today is on how much investment in the energy sector is going to be needed in the next 20 years (World Energy Investment Outlook). The numbers are sobering. They estimate that $48 trillion dollars needs to be invested to meet energy needs…but really it needs to be closer to $53 trillion if we want to address climate change. They don’t even bother talking about a 350 parts per million target, but rather 450 parts per million to limit global warming to 2 degrees C.

2014: Gloomy Times Ahead – An Energy System Under Stress

And so we come to the 2014 WEO, released today, November 12, 2014. The opening words of the executive summary offer a warning: “An energy system under stress. The global energy system is in danger of falling short of the hopes and expectations placed upon it. Turmoil in parts of the Middle East – which remains the only large source of low-cost oil – has rarely been greater since the oil shocks in the 1970s…” We are advised that the insights of this report “can help to ensure that the energy system is changed by design, rather than just by events.”

Kurt Cobb characterized the 2013 report as sounding “like a group of Gloomy Guses.” The 2014 report is, I believe, the gloomiest we’ve seen yet.

This year’s report projects to 2040, when energy demand is expected to have grown by 37%. For the last two decades demand has grown by 2% per year, but they see it slowing to 1% per year after 2025 as the result of price pressure (due to limited and more expensive energy), policy effects as the world attempts to grapple with climate change, and also due to an expected change in the structure of the global economy, with a greater emphasis on services and lighter industrial sectors. World demand growth is expected to decline to 0.3% by the 2030s as it moves towards a plateau in global oil consumption.

Energy Consumption in the U.S. Falls Back to Levels Not Seen in Decades

The report expects energy demand to stay flat in Europe, Japan, Korea, and North America, while we see rising consumption in China, India, Africa, the Middle East and Latin America. By the early 2030s, China is expected to become the largest oil-consuming country, while use in the United States “falls back to levels not seen for decades.”

A “Last Chance” to Contain Carbon Dioxide Emissions

We are reminded yet again that even though policies are in place that will bring the share of fossil-fuels in the energy mix to less than three-quarters in 2040 of what it is today, it won’t be enough to contain the rise in carbon-dioxide emissions that keep us on the path that could result in a global average temperature increase of 3.6 degrees C. Urgent action is required. A special report on climate action is being prepared for release in min-2015 in preparation for the UN climate summit in Paris, possibly a “last chance” to contain carbon-dioxide emissions – the Central Scenario shows that the entire global CO2 budget to 2100 that would hold us to 2 degrees C of warming will be used up by 2040.

Will Supply Meet Demand?

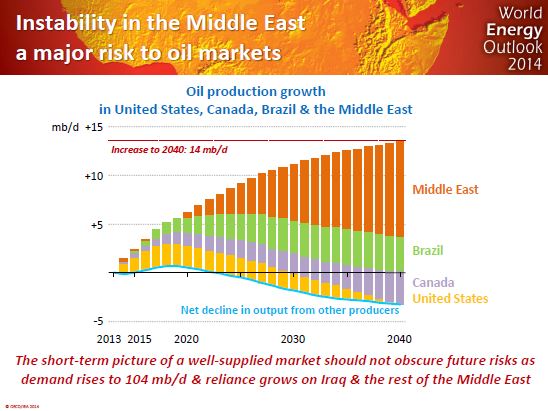

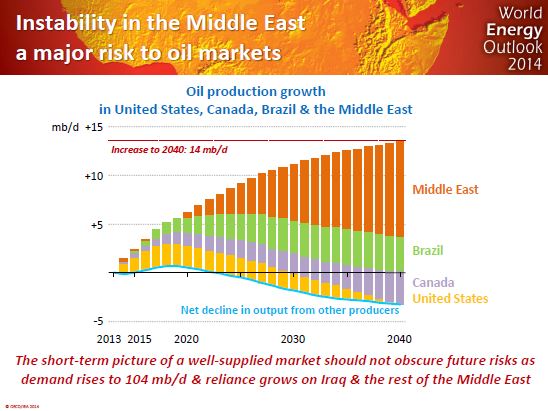

Demand for oil is expected to reach 104 mb/d in 2040. The question is will there be enough supply to meet this demand? I will quote at length from the executive summary:

“Investment of some $900 billion per year in upstream oil and gas development is needed by the 2030s to meet projected demand, but there are many uncertainties over whether this investment will be forthcoming in time – especially once United States tight oil output levels off in the early 2020s and its total production eventually starts to fall back. The complexity and capital-intensity of developing Brazilian deepwater fields, the difficulty of replicating the US tight oil experience at scale outside North America, unresolved questions over the outlook for growth in Canadian oil sands output, the sanctions that restrict Russian access to technologies and capital markets and – above all – the political and security challenges in Iraq could all contribute to a shortfall in investment below the levels required. The situation in the Middle East is a major concern given steadily increasing reliance on this region for oil production growth, especially for Asian countries that are set to import two out of every three barrels of crude traded internationally by 2040.”

Is There a Hidden Code in this Graph?

Note the graph below, taken from the slideshow accompanying the press release of this report, which shows declining output in the U.S. before 2020, and the enormous burden placed on Iraq and a small number of other Middle East countries after 2020 to make up both the shortfall from declines everywhere else, plus meeting expected demand – regardless of the instability in the Middle East, isn’t this conventional oil that the 2010 report told us had peaked in 2006?

Also discussed in the slide presentation are the low prices for oil that have manifested in recent months. It is pointed out that we now live in a time where high prices are necessary to sustain the more expensive processes necessary to extract the unconventional oils that are currently propping up supply. “Lower prices are starting to curtail upstream spending plans, with implications for future supply. Over time, squeezed cash flow would constrain the capacity of North America and Brazil to act as engines of global supply growth.”

Renewable Energy – Not Enough

Renewable energy received $120 billion in subsidies in 2013. Oil, coal, and gas received over 4 times that much, with $550 billion in subsidies. Looking at renewable industries to 2040, wind power is expected to grow globally by 34%, hydropower by 30%, and solar technologies by 18%. Renewables are expected to account for nearly half of the increase in total electricity generation by that time. Use of biofuels is expected to triple, and use of renewables for heat will more than double. Yet none of this will be enough to cut carbon dioxide emissions to acceptable levels.

Nuclear power is projected to increase by 60%, but its share of electricity generation will rise by only 1%. According to the IEA, if policies are enacted to decrease use of nuclear power (in its Low Nuclear Case scenario, global capacity drops by 7%), “indicators of energy security tend to deteriorate in those countries that utilize nuclear power.” It is also emphasized that “Nuclear power is one of the few options available at scale to reduce carbon-dioxide emissions while providing or displacing other forms of base load generation.” With almost 200 reactors scheduled to be retired, this presents an acute energy security challenge. The cost of decommissioning these nuclear facilities is estimated to be in the range of $100 billion, while acknowledging there are “considerable uncertainties” about these costs. The number of countries operating nuclear plants will rise from 31 to 36, “as newcomers outnumber those that phase out nuclear power.” The total of spent nuclear fuel will double, even though no country has yet opened a permanent disposal facility.

Power to Shape the Future in Sub-Saharan Africa

The Executive Summary closes as it usually does with attention given to areas of the world that have extremely limited access to adequate energy supplies. Emphasis is given this year to sub-Saharan Africa, where 620 million people do not have access to electricity and where 730 million do not have adequate cooking facilities, resulting in nearly 600,000 premature deaths per year due to indoor air pollution. The area is rich in largely undeveloped energy resources – the challenge being to develop these resources in ways that are equitable for the people who live in this region.

If you’ve read this far, you have my sincere thanks for sticking with it. The 2014 WEO is disturbing enough as it is, noting the numerous wicked problems and predicaments we face in regards to energy in these days of the early 21st century. As I wrote last June,

The IEA is becoming increasingly more realistic as they move beyond demand driven scenarios, and acknowledge that the era of easy oil is over. The alternatives we are left with are becoming increasingly expensive – from unconventional fossil fuels like tar sands and shale plays, to renewables. However, at some point (a point we may have already passed), geology responds less and less to the human construct we call money. We’re currently living at the high point of the fossil fuel Pulse, and I don’t believe we can negotiate an avoidance of the backside of the pulse’s decline – but we can take measures to make a graceful descent if we begin early enough (ten years ago).

I’d like to recommend two additional independently produced reports, which when combined, I feel give an even more realistic picture of what we’re dealing with in terms of oil supply.

The first is a presentation prepared by energy investment banker and analyst Steven Kopits, Global Oil Market Forecasting: Main Approaches and Key Drivers, which I wrote about here. and with a follow-up here. Kopits explains the predicament of the rising costs of oil production, and argues for supply based rather than demand based forecasting.

The second recommendation is Drilling Deeper: A Reality Check on U.S. Government Forecasts for a Lasting Tight Oil & Shale Gas Boom, by David Hughes, a respected and experienced geologist working for the Post Carbon Institute. This report confirms that tight oil in the U.S. will most likely peak before 2020 – matching the current IEA forecast, but the decline thereafter will probably be more rapid than the IEA is estimating. For a commentary on this report, see Asher Miller’s (executive director of Post Carbon Institute) The Revolution that Wasn’t: Why the Fracking Phenomenon Will Leave Us High and Dry.

Finally, if you’re wondering about the current decline in oil prices (I planned to cover it more in this piece, but ran out of space and time), check out Ugo Bardi and Gail Tverberg.

You can find the older WEO reports here.

Now, if this is the situation we find ourselves in with mainstream political discourse, with its unwillingness to consider options other than continued growth (about which see yesterday’s post here) – is there hope for meaningful action? If folks want to explore this further, consider the work of Peter Pogany, whom I’ve been reading lately. Pogany has pointed out that we currently live in a “world order” or “global system” (since approximately 1945) that is basically not capable of voluntarily moving beyond the paradigm of economic growth; therefore a chaotic transition to a new global system will be required :

Now, if this is the situation we find ourselves in with mainstream political discourse, with its unwillingness to consider options other than continued growth (about which see yesterday’s post here) – is there hope for meaningful action? If folks want to explore this further, consider the work of Peter Pogany, whom I’ve been reading lately. Pogany has pointed out that we currently live in a “world order” or “global system” (since approximately 1945) that is basically not capable of voluntarily moving beyond the paradigm of economic growth; therefore a chaotic transition to a new global system will be required :